The Importance of Decentralization in Cryptocurrency Markets

Author: speicherx

Cryptocurrencies today are making a big impact in the fast-changing world of digital finance, challenging conventional systems — with decentralization as the core attribute as to why they exist in the first place. Decentralization is crucial in cryptocurrency markets as it eliminates the need for central authorities, meaning that power and control are distributed across a network of participants rather than intermediaries. This reduces the risk of censorship, fraud, and mismanagement. By democratizing financial transactions, individuals also ultimately have greater control and autonomy over their assets, ensuring transparency and fairness. This is especially important for people residing in countries with hyperinflated currencies, or regions where access to financial services is highly restricted. Cryptocurrency offers users a path to financial independence, without reliance on traditional banking systems.

In today’s article, we will explore and elaborate further on the multifaceted benefits that decentralization brings to the table in cryptocurrency markets.

Benefits of Decentralization

1. Trust and Security

In traditional financial systems, trust is a prerequisite, requiring third-party intervention such as banks or brokers. This process is often bottlenecked by lengthy bureaucratic procedures as well. Decentralized blockchain technology, however, operates on a trustless model. This means that transactions and interactions within the network do not require trust between the parties involved. The network’s distributed ledger is virtually resistant to tampering, as any changes need the consensus of a majority of participants, such as in the case of validators and governance proposals. This architecture greatly reduces the risk of fraud and enhances the overall security of the network. This can also be extended to any other major community decision happening on the network. One would remember the notorious Juno Proposal 16 to revoke $35M worth of tokens from a Whale–that was one such example of decentralized governance in action.

2. Data Integrity and Reduced Downtime

Traditional business systems, with their isolated data silos, are prone to errors and data loss. In contrast, decentralized blockchains replicate data across multiple nodes. This ensures that the data is not only accurate but also constantly available, mitigating the risk of a single point of failure. This is particularly applicable to operating multiple financial systems in one place, where a single point of failure should be avoided. The Cosmos ecosystem is a prime example, connecting multiple chains via Inter-Blockchain Communications. It ensures that chains are interoperable while maintaining each chain’s sovereignty. Following the $40 billion Terra UST crash in May 2022, most funds in the Cosmos chains operating within the ecosystem were not directly affected by the incident. Moreover, decentralized networks have the advantage of reduced downtime and smoother operations, a critical factor in financial transactions where speed is important. Today, many teams are continually improving this aspect of blockchain technology. For instance, the recent partnership between the NEAR Foundation and Polygon aims to integrate zk technology into WASM chains, setting out to streamline the validator proving process, marking an improvement in speed over the need to verify individual shards.

3. Transparency and User Empowerment

Another key advantage of decentralization is the transparency and control it offers users. Decentralized blockchains are public, allowing anyone to view transactions and network activity. This level of openness builds trust among users and provides a level of oversight not available in traditional financial systems. The transparency in blockchain has helped protect numerous users, from tracking large whale movements to identifying vulnerabilities like wallet hacks and more. ZachXBT, a renowned CT account, has uncovered many scammers across the crypto industry simply by using blockchain explorer records. In a decentralized network, users have more control over their data and transactions and are not at the mercy of a central authority that could manipulate or restrict access to their information.

4. Financial Independence

Decentralization in cryptocurrency markets creates opportunities for users globally to achieve financial independence. With 24/7 accessibility to the markets and not being bound by traditional means, users can engage in various financial activities without the need for centralized intermediaries. This freedom is especially crucial in regions experiencing hyperinflation or economic instability, where cryptocurrencies offer a more viable alternative to local currencies, without the fear of devaluation or governmental interference.

Achieving Financial Independence with Decentralized Finance

Over the past decade, the field of decentralized finance has evolved beyond basic currency transactions into the realm of more intricate financial services. This expansion encompasses a wide range, including Liquid Staking, Decentralized Exchanges (DEXes), and Decentralized Perpetuals, illustrating the industry’s growth in fostering a comprehensive financial ecosystem.

-

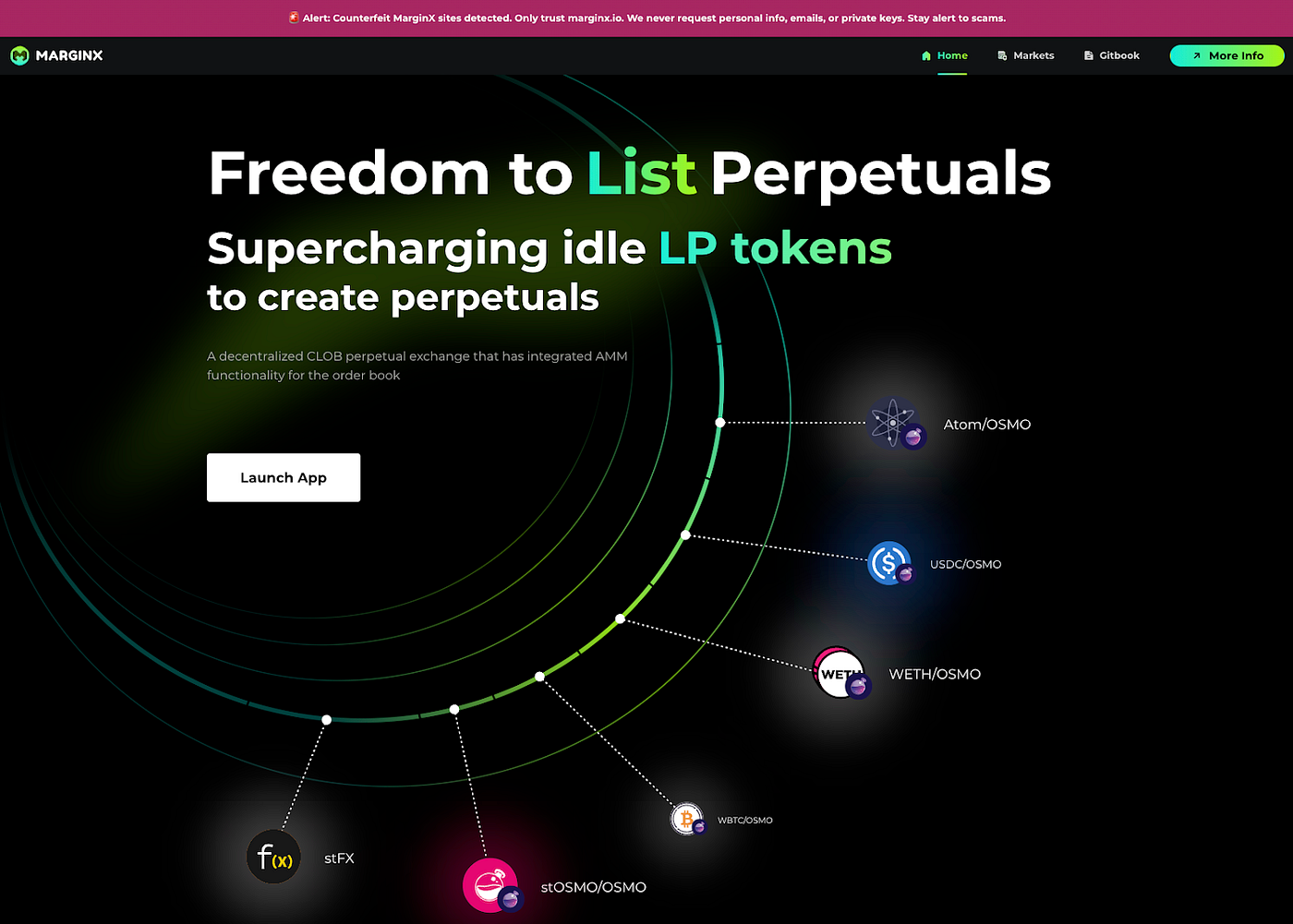

MarginX

Focusing on the freedom of trading and listing in decentralized finance, our team at MarginX 2.0 introduces a significant upgrade to perpetual trading. This version decentralizes both “listing” and “market-making,” employing the Automated Market Maker (AMM) approach for perpetual order books, known as “Automated Limit Order Book Market Maker For Perpetual Market” or “ALO.” Market participants can choose assets for trading or liquidity provision based on their risk preferences. This model mirrors Uniswap’s functionality, tailored for perpetual contracts, where liquidity providers can list any desired pair, with trading and funding fees, as well as profits and losses, distributed among them.

Our testnet is currently live! By 2024, we aim to integrate a funding relay smart contract on other chains, support EVM ecosystem LP tokens and Metamask, and introduce an external liquidator module.

-

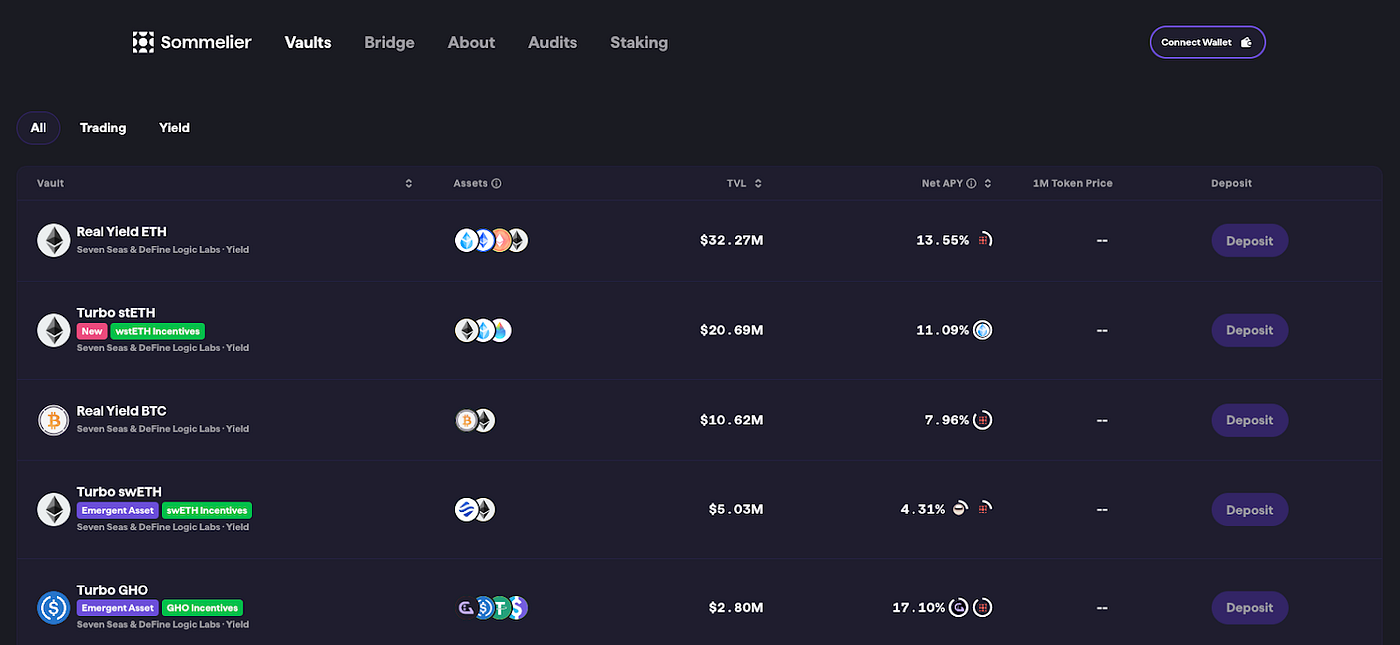

Sommelier

Sommelier enhances DeFi for smaller investors. Its “Ethereum Coprocessor” automates DeFi position management, mitigating impermanent loss in AMM pools using Cosmos blockchain technology, Gravity bridge, and Ethereum oracles. This system enables more flexible adjustment of investments and offers advanced financial functionalities. As of today, Sommelier boasts 22 vaults with a total value locked (TVL) of $51.7 million!

-

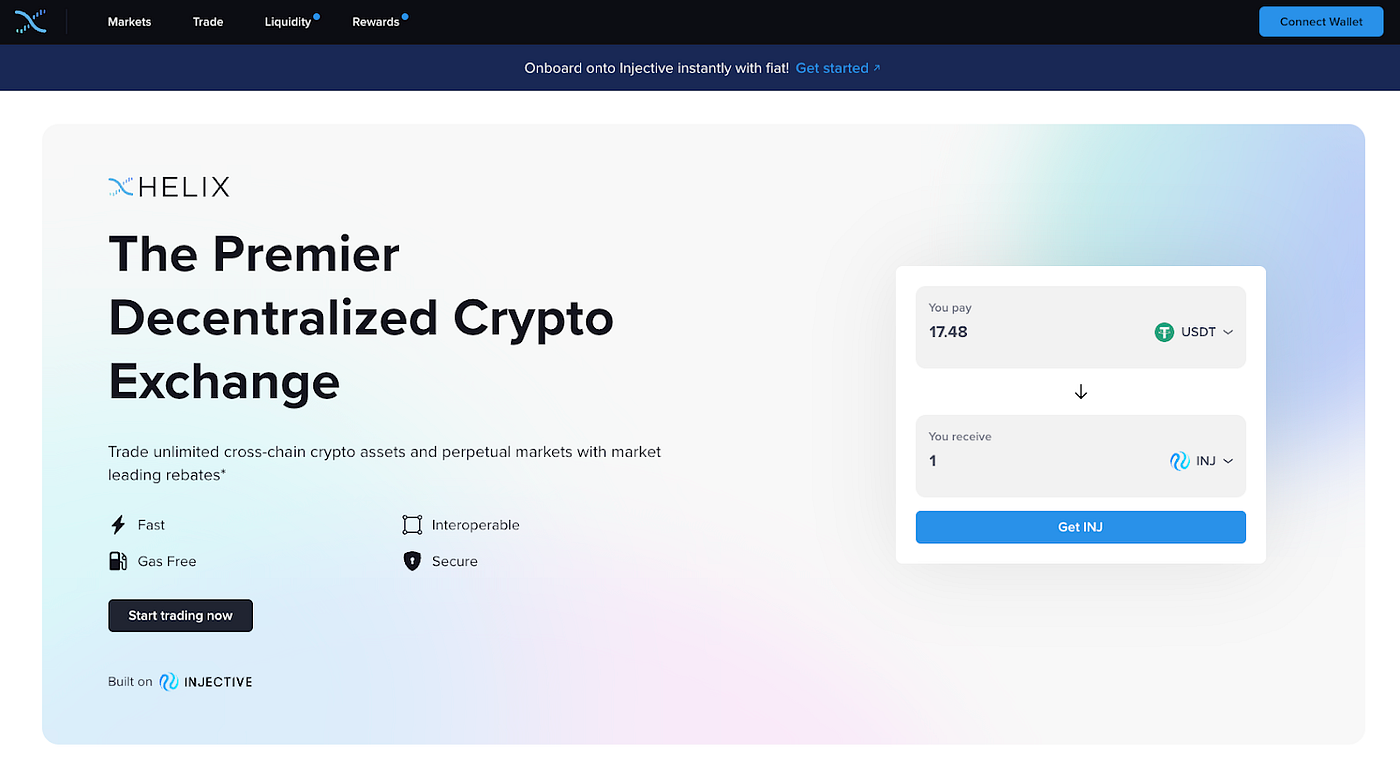

Helix

Formerly known as Injective Pro, Helix is a rebranded decentralized derivatives exchange offering features like stop-limit orders and a Convert interface for simplified asset swapping. Designed for all traders, new or native, Helix provides an intuitive trading environment with low fees, including negative maker fees on certain listings. As a fully decentralized order book exchange, Helix emphasizes security, speed, and low costs, aiming to make decentralized trading accessible to a broader audience.

Closing Thoughts

At its core, decentralization is more than just a technical feature; it’s a concept that empowers individuals. It’s about allowing people more control and autonomy over their assets and creating a financial system that’s transparent, equitable, and accessible to all.

The growth of decentralized finance platforms like MarginX 2.0, with our Automated Limit Order Book Market system for perpetual markets, Sommelier’s Ethereum Coprocessor aiding in DeFi position management, and Helix’s approach to decentralized trading, all highlight significant strides that the industry has taken over the last decade. This is the essence of decentralization in the world of cryptocurrency markets, a journey that’s as much about people and financial empowerment as it is about technology — a principle we hold close to ourselves at MarginX.

Disclaimer: The content provided here is for informational purposes only and does not constitute financial, investment, legal, or tax advice. DYOR!