A Beginner’s Guide to Decentralized Derivatives

Author: speicherx

Decentralized finance has always been built upon the core principle of creating an open, permissionless, and transparent field for anyone to access. In contrast to centralized finance, where intermediaries are involved, decentralized finance utilizes blockchain technology and smart contracts to operate functions similar to those we see in banks and other institutions. As quoted by Vitalik Buterin, the founder of Ethereum, “Blockchain has the power to democratize access to financial services and empower the unbanked.”

Decentralized derivatives represent a critical component of this burgeoning sector. In a report from DeFi Pulse, blockchain-based derivatives platforms have soared from a figure of roughly $145 million in February 2020 to more than $1 billion today, all within the span of less than 2 years, even considering the current bear market.

Platforms like GMX have surged to prominence and reportedly processed over $500 million in trades within just the first few months of its launch in September 2021. Their V1 has a total of over 310k unique users from both Arbitrum and Avalanche, illustrating the growing interest and trust in decentralized derivative platforms, which quickly led to the development of a flurry of other similar protocols like Synthetix. In the swiftly evolving sector of cryptocurrency, decentralized derivatives offer a much more democratized approach to financial services, including hedging risks, price discovery, and arbitrage.

So, what exactly are decentralized derivatives, why do they matter, and how can we leverage them?

Dive into this guide as we explore the intricate yet fascinating world of decentralized finance and the underlying mechanics of derivatives — also find out below how you can grab a chance to earn $500 USDT with MarginX!

Understanding Derivatives: Benefits and Examples

Before we delve deeper, it’s important to first understand what derivatives are.

They are essentially financial contracts whose values are derived from underlying assets such as stocks, commodities, or, in this case, cryptocurrency tokens. These contracts offer multiple benefits, such as risk hedging, price discovery, increased asset exposure, and the ability to gain extra profits (or incur losses) through leverage.

One popular example is the perpetual contract, which is a form of derivative without an expiration date. Rooted in the concept proposed by economist Robert Shiller, perpetual contracts have allowed traders to speculate on price movements without the necessity of owning the underlying assets, particularly for illiquid markets. They also don’t settle, unlike traditional futures contracts. As such, perpetual contracts have gained immense popularity due to their flexibility and higher leverage features.

Deep Dive into Perpetual Contracts and Platforms

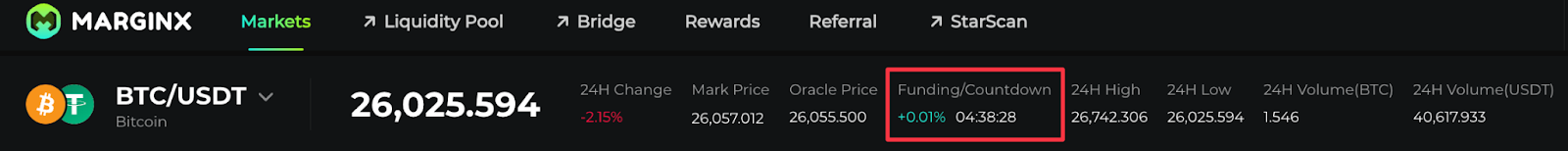

Perpetual contracts are decentralized derivatives with no expiration date; so instead, they use a mechanism called the ‘funding rate’ to ensure that the contract price stays in congruity with the underlying asset’s market price. This allows traders to hold their positions indefinitely, with the funding rate feature tethering the market price to the index price of the underlying asset.

By trading perpetuals, you can participate in market movements and make a profit by going long or short with leverage on a futures contract. Traders are either rewarded or penalized based on whether the contract is trading at a premium or discount to the spot price, depending on market dynamics. This allows traders to capitalize on price discrepancies or arbitrage between the perpetual contract and the spot market, making it attractive for both hedgers and speculators. With the absence of a settlement date, traders can maintain their position as long as they maintain the necessary margin, allowing for longer-term strategies.

In this case, the funding rate is positive, suggesting bullish sentiment in the market, with more people willing to pay a premium to maintain their positions. Thus, traders who are long (buying) will pay funding to traders who are short (selling). This funding rate is crucial as it acts as a mechanism to push the perpetual contract price back towards the spot price. Extended periods of high positive funding rates might compel long traders to close their positions, pushing the price toward equilibrium.

The countdown is also important, as funding rates change every stipulated period, which would be another thing to monitor as you adjust your strategies.

Recap: Long vs. Short

Long

Going long implies that when a trader buys into a perpetual contract, the trader anticipates that the underlying asset will rise in value in the future. This allows them to gain from synthetic exposure to the asset’s increase, without actually owning it.

Short

Going short implies that when a trader sells a perpetual contract, the trader anticipates that the underlying asset will fall in value in the future. This allows them to benefit from synthetic exposure to the asset’s decline, without actually owning it.

The Challenges of Derivatives and Future Outlook on Regulations

However, despite the high leverage and hedging opportunities, perpetual contracts also have significant downsides. Due to their decentralized nature, there are risks of malicious security exploits that could lead to a loss of funds. While users can practice due diligence and employ good OPSEC measures, the non-custodial nature of the industry means that there is often no default protection if they become victims of a platform-wide hack. One example is Deus Finance, which was exploited for $3 Million on Fantom Network in 2022. Beyond the complexity of navigating decentralized platforms and the substantial counterparty risk, there’s also a current lack of clear regulatory pathways.

In early 2022, the U.S. Commodity Futures Trading Commission (CFTC) took decisive action by levying charges against Polymarket, a blockchain-based platform that allowed users to engage in binary event option contracts, categorizing them as ‘swaps’ under the Commodity Exchange Act (CEA). Polymarket agreed to settle non-compliant contracts and paid a substantial penalty of $1.4 million. Nonetheless, the manner in which the CFTC plans to regulate decentralized entities remains largely undefined. The decentralized finance landscape urgently needs refined regulations and a solid security infrastructure for innovation to flourish and gain broader acceptance.

Exploring MarginX: A Leading Perpetual Platform

If you haven’t heard already, MarginX is poised to revolutionize perpetual trading platforms with its new ALO (Automated Limit Order Book Market Maker), specifically designed for the perpetual market in its V2 release. This unique system combines the advantages of Automated Market Makers (AMMs) with the listing features intrinsic to the Limit Order Book model, enhancing the liquidity of perpetual order books.

Inspired by platforms like Uniswap, which allow users to provide liquidity for spot trading, MarginX aims to offer similar autonomy to perpetual markets. MarginX’s V2 technology focuses on Liquidity Pools and Position Pools. Liquidity Pools gather funds, while Position Pools handle ‘long’ and ‘short’ orders. Together, they automate limit orders using formulas and oracle prices, optimizing order book dynamics.

Closing Thoughts

Decentralized derivatives are becoming the linchpin of the evolving digital finance sector, as evidenced by statistics and volumes from various platforms. With emerging protocols like MarginX showcasing innovative frameworks to further optimize and improve the trading experience, it’s evident that we are approaching a new era of financial interactions.

However, building in this industry is not devoid of challenges, primarily revolving around the significant gap between retail-user onboarding and looming regulatory uncertainties. The scrutiny by regulatory bodies hints at a growing need for well-defined regulations that ensure both compliance and security in decentralized transactions, without stifling the innovation that fuels this sector. It’s also vital that protocols today help newcomers approach with informed caution and foster robust security measures to achieve sustained growth. As blockchain technology develops further, the utility cases for decentralized derivatives will only continue to grow.