Growth of Decentralized Perpetual Trading Platforms on Cosmos in 2023

Author: speicherx

As hints of a potential new bull run surface within the crypto community, interest in decentralized perpetual trading protocols is noticeably increasing. These platforms have established a unique position in the DeFi sector by providing leveraged trading opportunities to retail investors, without the geographical and regulatory restrictions typically associated with traditional account setup. Leveraged trading appeals to investors eager for speculative bets by enhancing their strategies and offering the potential for steady returns from transaction fees, thereby contributing to the increased global accessibility of financial markets.

Additionally, the Cosmos ecosystem has recently made headlines with the successful launch of Celestia, the upgrade of Nomic nBTC, and the Landslide network. Today, this article will explore the growth and current state of decentralized perpetual trading platforms on Cosmos in 2023. We will cover the increasing prominence of platforms such as dYdX, Levana, DEMEX, and also us at MarginX 2.0, highlighting the evolutions over the past few months.

dYdX: A New Perpetual Horizon on the Cosmos

The dYdX exchange recently announced it has open-sourced its code, marking the initiation of the exchange’s upgrade to version 4 (v4) of the platform. This progression marks a transition towards a more decentralized framework from Ethereum to a sovereign blockchain based in the Cosmos ecosystem, aligning with the foundational principles of community-driven development and openness.

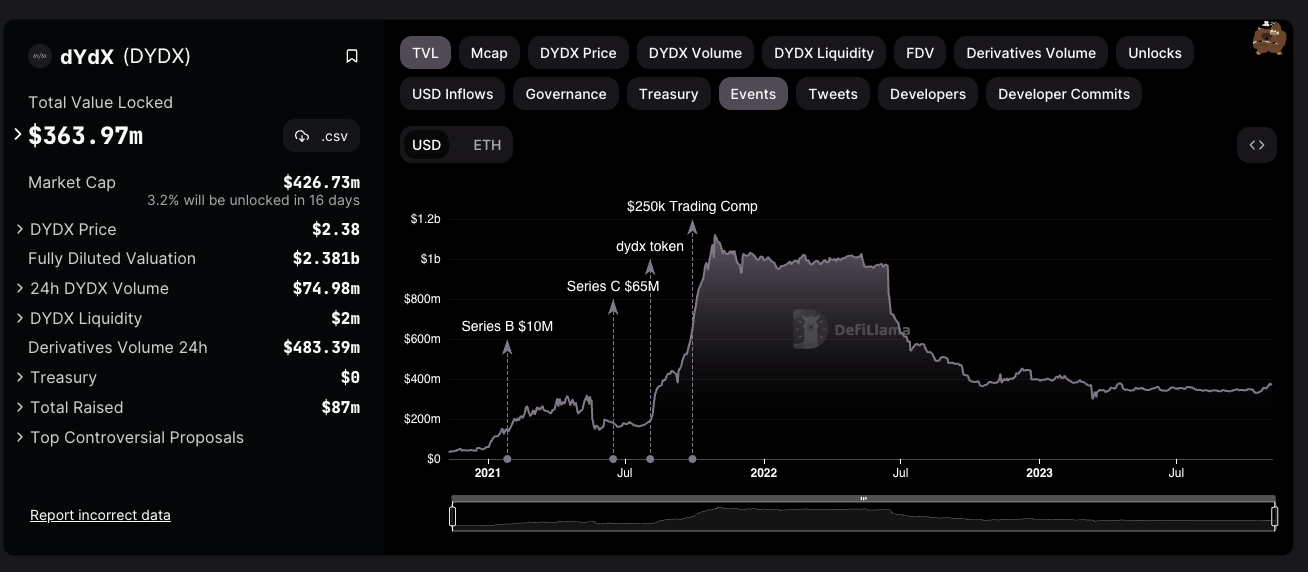

According to data from DeFiLlama, dYdX currently holds a Total Value Locked (TVL) of $363.9M and boasts a market cap of $426.7M as of November 5th. The platform’s daily trading volume also often exceeds $1 billion, reflecting a positive reception from the overall market demand. The anticipated launch of the mainnet, which is pending approval from governance, is set to further move dYdX away from a company-centric model to one that is governed by its user community. This strategic shift will also eliminate any fees or profits that would traditionally benefit the core entity, empowering the users instead, while simultaneously rolling out advanced trading mechanisms.

Levana Protocol: Leverage Trading with Segregated Pools

Despite the treacherous bear market and the downfall of LUNA UST, the Levana team continued to develop and introduced its Levana Perps v2, featuring segregated pools. Differing from their competitors, this design choice aims to mitigate solvency risks and facilitates the introduction of a wide array of assets. For ex-Terra users who remember the Mirror Protocol, there was essentially a lack of platforms that allowed operation with synthetic assets. Levana’s model worked to include not only various cryptocurrencies but also ETFs, commodities, and forex trading. Offering up to 30x leverage on cryptocurrency assets and 100x leverage on Forex assets, Levana broadened its appeal to traders interested in significant leverage opportunities.

Levana’s single-sided liquidity pools also generate revenue solely from trading activities, which relates to the concept of ‘Real Yield.’ Instead of creating an ecosystem where yields are derived from token-based incentives, Levana Protocol ensures that liquidity providers are not only participating in trading but are also rightly rewarded for their staked assets. Launched in September 2023, the platform has since achieved a notable trading volume, surpassing $200M, and a Total Value Locked (TVL) close to $4M.

Kujira Academy also provided an interesting comparison of revenue statistics between Levana and other popular related perpetual trading platforms:

Here is a comparison of the revenue stats of other perps products within Cosmos and in ecosystems with similar TVL as Kujira (10/25/23): pic.twitter.com/IcRCPcms7l

— Kujira Academy 🧑🎓 (@KujiraAcademy) November 2, 2023

DEMEX: Introducing Perp Pools by Fluo

DEMEX, in partnership with Fluo Finance, has introduced Perp Pools for perpetual futures markets as part of their platform features. They first launched their incentivized public devnet for perpetual pools in August 2023, alongside also offering up to 100x leverage on cryptocurrency pairs.

Perpetual pools on DEMEX empower liquidity providers to assume the role of market makers, which were previously limited to centralized entities, enabling them to provide liquidity and earn through trading and funding fees. By leveraging both the Carbon Network’s Hybrid Liquidity Engine and the Fluo-powered AMM system, DEMEX ensures robust liquidity within these markets, addressing the challenge of insufficient liquidity. Furthermore, these pools enhance capital efficiency by allocating liquidity across various markets, thus elevating the potential for users to earn better yields.

According to the team, tests have indicated the possibility of achieving over +200% annualized yield for participants, although such figures are subject to market risks and conditions.

Read their blog here for more information: https://blog.dem.exchange/introducing-demex-perp-pools-by-fluo/

MarginX 2.0: User-Powered Perpetual Listings & Trading

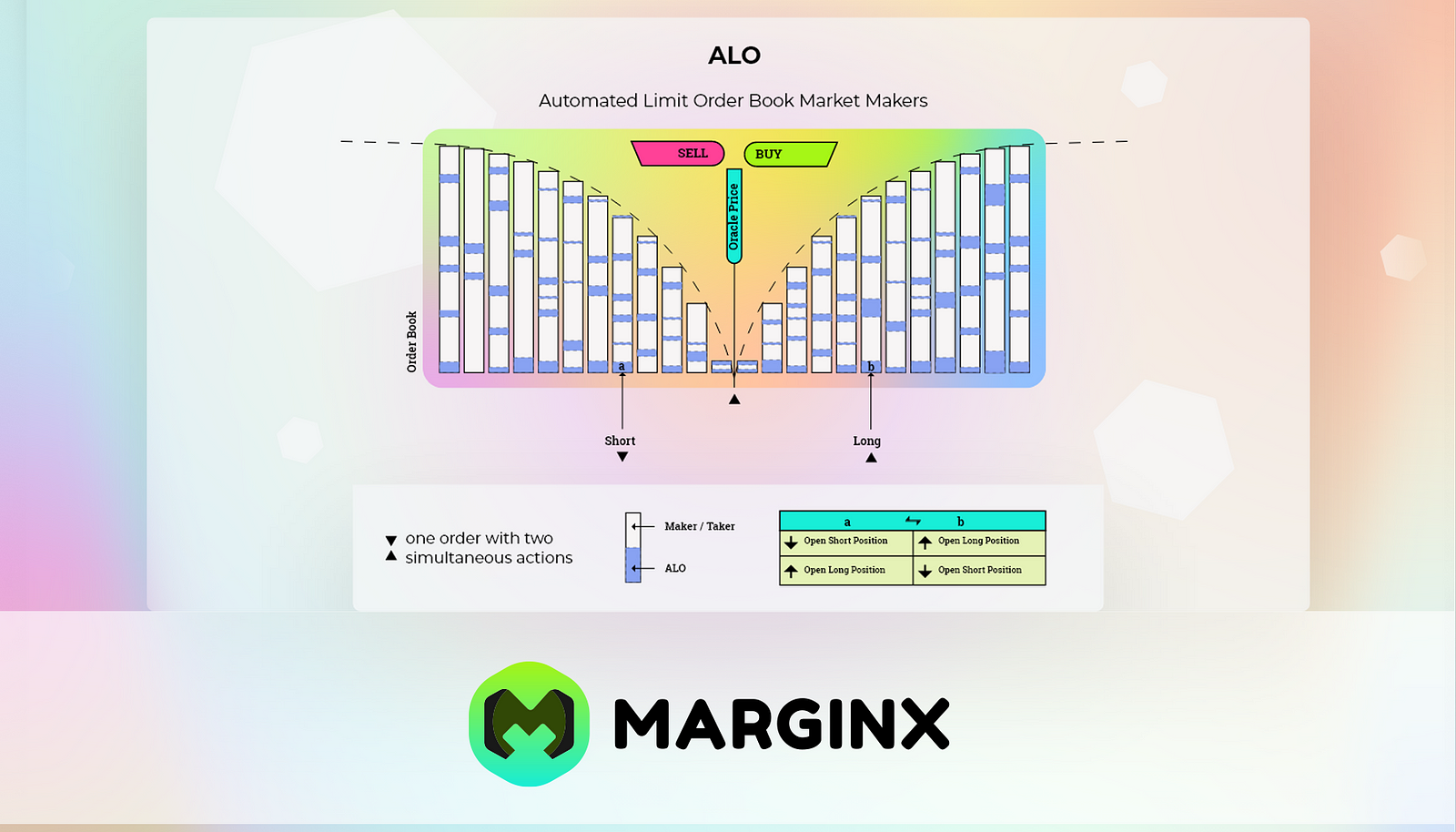

The team at MarginX is excited to share that we have successfully deployed our MarginX 2.0 Testnet — a pivotal development in the evolution of decentralized perpetual trading!

Launched during Cosmoverse 2023, this upgrade represents our unwavering commitment to upholding the principles of decentralization and financial inclusion. With this update, we empower our users to design their own permissionless perpetual markets and move away from rigid trading conditions. Our approach allows our users the flexibility to configure perpetual pairs as they desire, setting their own trading parameters according to their risk and reward preferences.

We also have a strong dedication to nurturing a vibrant community at MarginX, as without our supporters, we would not be able to achieve what we have today. To reward our loyal participants, we have initiated a series of ongoing campaigns on our Twitter to encourage engagement on our Testnet. Your feedback is valuable to us!

Keen to find out more about MarginX 2.0 and what we’re doing differently on Cosmos? Make sure you check out our article below:

https://blog.marginx.io/marginx-2-0-testnet-now-live-earn-rewards-for-participating-2c6e1e35839f

Disclaimer: The content provided here is for informational purposes only and is not intended as financial advice. Readers are advised to conduct their own research before making any financial decisions. DYOR!

Quick Links

- Margin 2.0 ALO Testnet: https://testnet-alo.marginx.io/

- MarginX 2.0 Vaults: https://testnet-alo.marginx.io/vaults

- MarginX v2.0 Site: https://marginx.io

- Test Tokens: https://testnet-faucet.marginx.io/

- MarginX v1.0 Perpetual Trading (Testnet): https://testnet-trade.marginx.io

- Video Guide: https://bit.ly/mxaloyoutube

- PDF Guide: https://bit.ly/MXALOtestnet

- GitBook: https://marginxlabs.gitbook.io/product-docs/